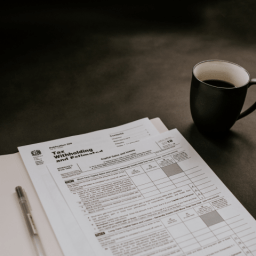

As part of payroll processing, there are mandatory payroll deductions, such as PAYE, which must be subtracted from your employees’ salaries or wages. Additionally, there may be voluntary requests for payroll deductions made on behalf of your employees.

Pay as you earn (PAYE) is a tax that employers deduct from the wages or salary paid to their employees, which includes a contribution towards their ACC earner’s levy. To determine the correct amount to withhold from employee pay, Inland Revenue offers PAYE deduction tables and calculators. Accounting or payroll software can also simplify the PAYE process for employers.

The schedular payment rules under tax laws have been expanded to apply to all contractors. As a result, many contractors now have the option to request tax deductions from their payments, provided that the payer agrees. However, contractors who are hired and paid through recruitment agencies or labour-hire businesses are required to have tax deducted.

Contractors are given the flexibility to choose the tax deduction rate that suits them best. Tax residents in New Zealand can choose any rate between 10% and 100%.

KiwiSaver is a voluntary retirement savings scheme designed to assist New Zealanders with long-term savings.

Upon hiring an employee, it’s important to confirm their eligibility to join the KiwiSaver scheme. If they are eligible but not yet registered, you must enrol them, even if they later choose to opt-out. Your employees have the option to choose how much they wish to contribute to their KiwiSaver account, and their contributions will be deducted from their pay. Additionally, employers are required to make contributions to their employees’ accounts.

It’s worth noting that any contributions made to your employee’s KiwiSaver or other superannuation schemes will be taxed. The tax could be either employer superannuation contribution tax (ESCT) or PAYE.

ESCT is deducted from employer contributions to an employee’s KiwiSaver or complying funds, which are superannuation schemes that follow rules similar to KiwiSaver. For instance, members’ savings are locked in until they become eligible for NZ Superannuation.

If an employee has a student loan, deductions may need to be made from their salary or wages. The amount of these deductions is determined by their income.

The Inland Revenue’s PAYE deduction tables and calculators will assist you in determining the correct amount to withhold from their pay based on their income.

While it is essential to make mandatory deductions, employees can request additional payments, and they will inform you of the amount to be deducted from their pay. Additionally, the Inland Revenue may ask for extra compulsory payments to be deducted to contribute towards student loans.

Deductions from salary and wages — Inland Revenue

If child support needs to be deducted from an employee’s salary or wages, the Inland Revenue will provide you with a child support deduction notice.

- The frequency of your employees’ payments

- The upcoming pay period or pay date

- Whether you wish to include an employee reference in the deduction notice.

The Inland Revenue will inform you of the amount to be deducted from your employee’s pay. You are only authorised to cease making child support deductions if the Inland Revenue instructs you to do so; employees do not have the authority to make this decision.

Deductions from salary and wages — Inland Revenue

By filing your returns through Inland Revenue’s myIR online service, you can offer your employees the opportunity to participate in payroll giving, enabling them to donate a portion of their pay to a charity of their choosing.

Employees may request that you deduct a percentage of their salary or wages and contribute it to an authorised charity. They will receive a tax credit of approximately 33 cents for every dollar they donate.

Payroll giving — Inland Revenue